what percentage of taxes are taken out of paycheck in nc

However they dont include all taxes related to payroll. What is the percentage that is taken out of a paycheck.

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

. Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. This can make filing state taxes in the state relatively. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525.

The amount of taxes to be. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were. North Carolina moved to a flat income tax beginning with tax year 2014.

Just enter the wages tax withholdings and other information required. The median household income is 52752 2017. FICA taxes consist of Social Security and Medicare taxes.

However you can claim an adjustment or deduction for a portion of. The Calculator will help you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck. This North Carolina hourly paycheck.

On the other hand when you are self-employed you pay both portions of these taxes ie a total of 153. The money also grows tax-free so that you only pay income tax when you withdraw it at which point it has hopefully grown substantially. Divide this number by the gross pay to determine the percentage of taxes taken out of a.

North Carolina Income Taxes. Social Security Tax. That rate applies to.

Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. North Carolina has a flat income tax rate of 525 meaning all taxpayers pay this rate regardless of their taxable income or filing status. The income tax is a flat rate of 499.

Each employers payroll for the last three fiscal years as of July 31 of the current year. To use the calculator. These taxes are the same whether you pay employees hourly salary or per-diem.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. No state-level payroll tax. Some deductions from your paycheck are made.

It is not a substitute for the advice of an accountant or other tax professional. FICA taxes are commonly called the payroll tax. Raleigh NC 27609 Map It.

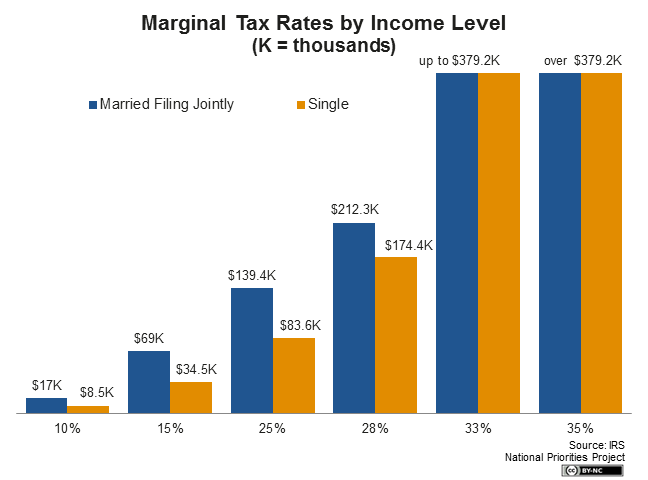

For tax year 2021 all taxpayers pay a flat rate of 525. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is. Current FICA tax rates.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Take Your 2019 Standard Deduction. The current tax rate for social security is 62 for the employer and 62 for the employee or.

You will pay a few federal taxes and some are withheld from your employees pay. What percentage is typically taken out of paycheck for taxes. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding.

Based on economic conditions an employers tax rate could be as low as 0060 or as high as 5760.

Explaining Paychecks To Your Employees

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Salary Paycheck Calculator Calculate Net Income Adp

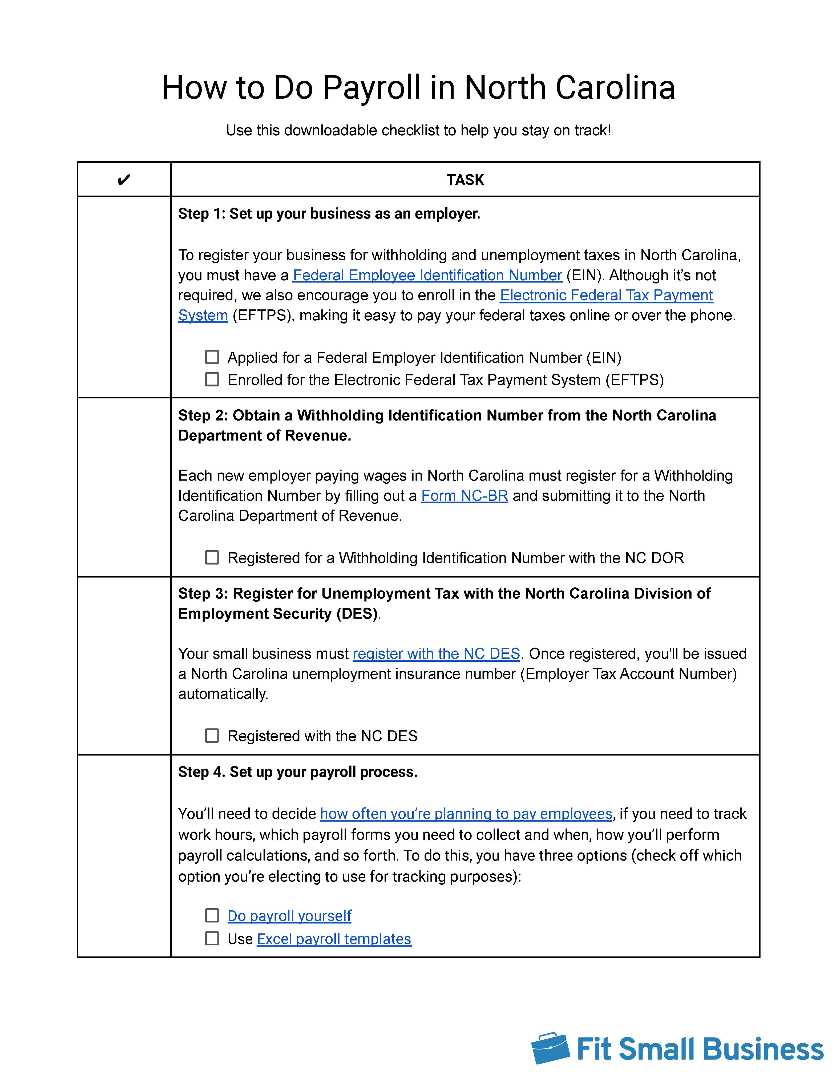

How To Do Payroll In North Carolina Detailed Guide For Employers

Why Did Tax Revenues Increase In Nc Other States During Pandemic Ncsu Texas Researcher Say Wral Techwire

Tax Calculator Shows How Much You Pay In Nc Income Taxes Raleigh News Observer

5 Best And Worst Things To Do With Your Paycheck Thestreet

Pbmares Insights 2021 North Carolina Tax Reform

State Income Tax Rates And Brackets 2021 Tax Foundation

How To Complete Your Nc Withholding Allowance Form Nc 4 Youtube

Visualizing Taxes Deducted From Your Paycheck In Every State

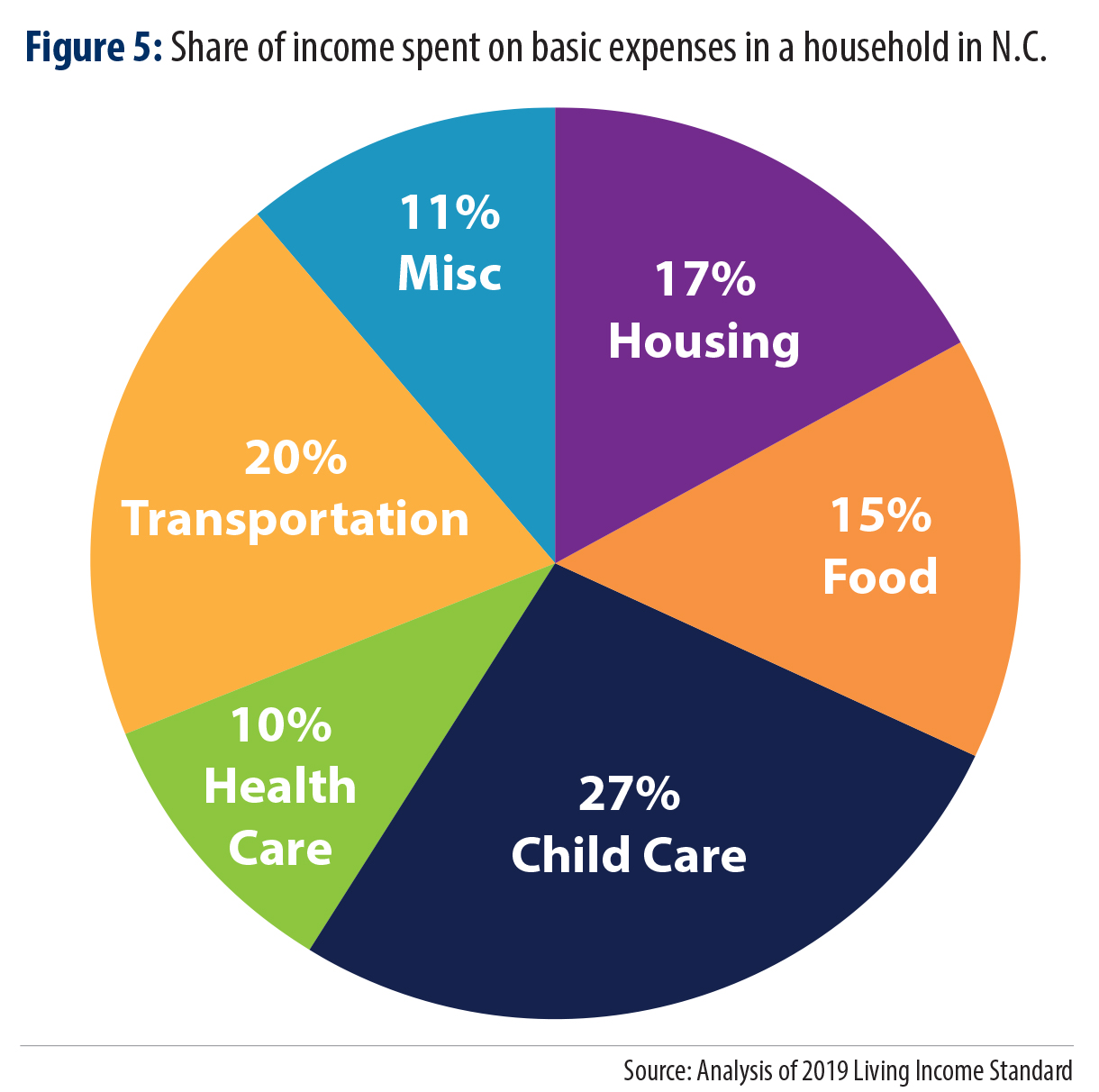

The 2019 Living Income Standard For 100 Counties North Carolina Justice Center

Richest North Carolinians Already Pay So Little In Taxes Senate Budget Would Make It Even Worse The Pulse

North Carolina Paycheck Calculator Smartasset

North Carolina Budget Includes Package Of Tax Reductions Weaver

![]()

North Carolina Paycheck Calculator 2022 With Income Tax Brackets Investomatica